Comparing Utmost Apex Portugal Bond and Moventum: Which Is Better for Your Money

Choosing between Utmost Apex Portugal Bond and Moventum can affect your long-term investment returns. The platforms differ in their fees, available products, and service quality. These differences could save or cost you thousands as time goes by. Your choice matters whether you're an experienced investor or just getting started.

Utmost Apex and Moventum each have strong features, but they're quite different in how they charge fees and what investments they offer. A full picture of their fee structures shows that even small percentage differences add up to big money over time. On top of that, each platform stands out in its own way – from Portugal bond availability to regulatory safeguards and user experience.

Fixed Income Investor covers all you need to know about these investment options. Depending on your investment amount, preferred assets, and geographical location, you can determine which platform is more suitable for you. The decision you make between Utmost Apex Portugal Bond and Moventum could significantly impact the future of your investment portfolio.

Platform Overview: Utmost Apex vs Moventum

The key to making a smart investment decision lies in understanding how these platforms work. Let's head over to the main differences between Utmost Apex and Moventum in their basic structure, rules, and how easy they are to use.

Regulatory Status and Licensing

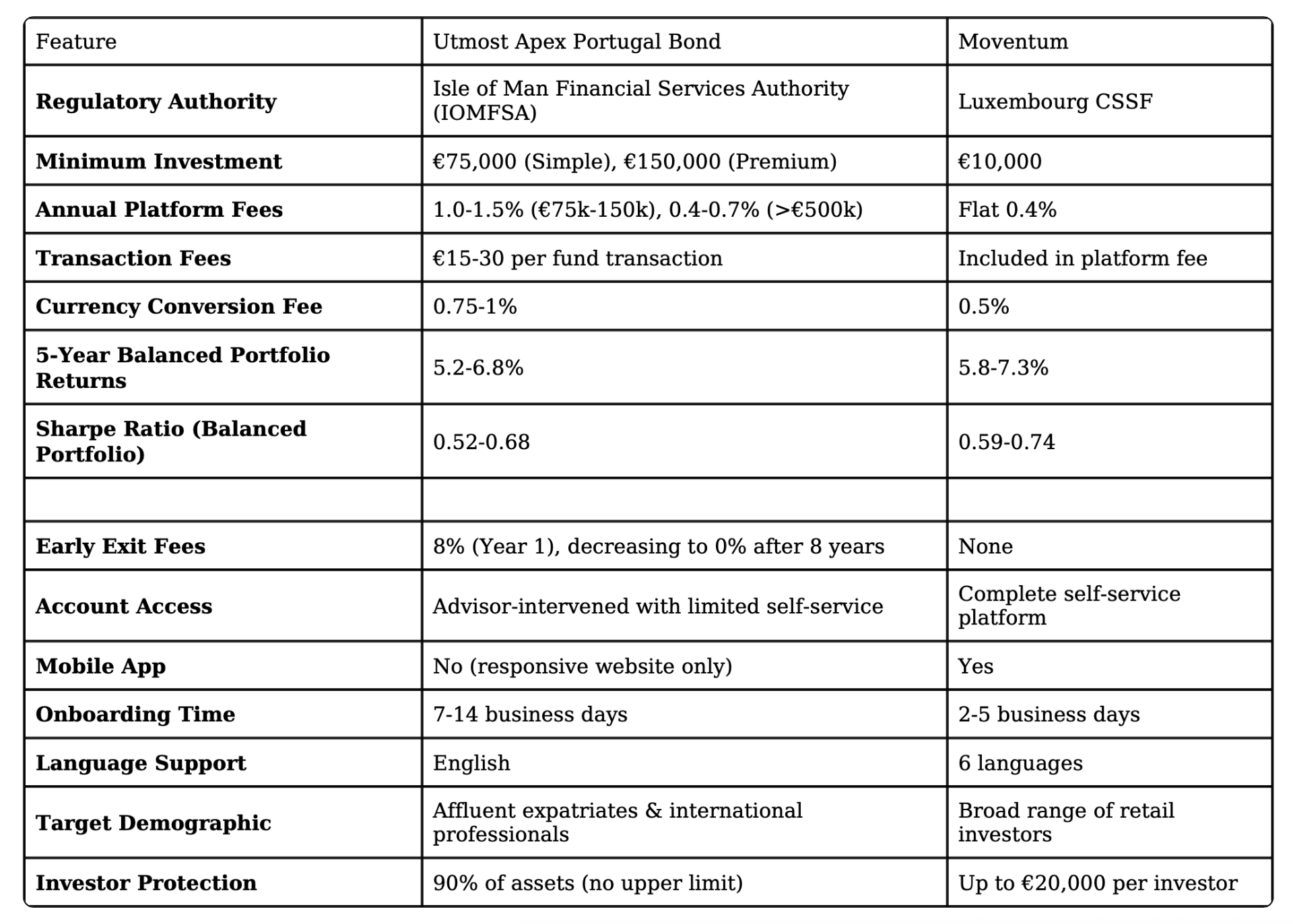

These platforms follow strict rules, but each answers to different authorities. Utmost Apex works under the Isle of Man Financial Services Authority (IOMFSA), which is known to protect investors well. Their rules make sure your money stays separate from the company's funds, which adds an extra safety net.

Moventum operates under Luxembourg's financial rules through the Commission de Surveillance du Secteur Financier (CSSF). Luxembourg's financial system is stable and works well with EU laws. This makes a big difference for investors who work across European markets.

Both platforms follow international rules too, including anti-money laundering laws and MiFID II requirements. These rules shape everything from how they report their activities to how they protect your money if things go wrong.

Target Investor Demographics

Each platform serves different types of investors, which explains why they work differently. Utmost Apex focuses on wealthy expats and international professionals who want to grow and protect their wealth. Their services work best for investors with over €100,000, especially those looking for tax-smart investment options.

Moventum, however, welcomes more types of investors:

Middle-range retail investors who want diverse fund options

Independent investors who like platform flexibility

You can see these differences in their minimum investment amounts and services. Utmost Apex asks for higher minimum investments. Moventum lets you start with less money.

Geographic Availability and Access

These platforms differ in where and how you can use them. Utmost Apex focuses on specific markets with lots of expats, mainly in Europe, the Middle East, and parts of Asia. Their Portugal bond products are specifically designed for Portugal's tax residents.

Moventum gives broader access across Europe from its Luxembourg base, though some products might not be available everywhere. They make it easy for EU residents to invest while following each country's rules.

The digital experience varies between these providers too. Utmost Apex works mainly through financial advisors and wealth managers, which means a more guided investment journey. You can view your account online, but many actions need an advisor's help.

Moventum takes a more direct approach. Their complete online access lets you make trades, check performance, and get documents without needing help. Their resilient infrastructure supports multiple languages and currencies, which works well for their European focus.

Opening an account works differently on each platform. Utmost Apex uses a traditional approach with lots of paperwork and advisor help. Moventum offers a simple digital process where you can verify your identity electronically in many markets.

These basic differences in rules, target customers, and accessibility create unique investment environments that suit different investor needs and preferences.

Investment Products and Bond Access

Product selection plays a decisive role in comparing platforms like Utmost Apex and Moventum. The available investment vehicles on each platform can affect your potential returns and flexibility, beyond just regulatory frameworks and target demographics.

Portugal Bond Availability and Terms

These platforms take different approaches to Portugal-specific bond access. Utmost Apex focuses on Portugal bond offerings and gives dedicated access to Portuguese government bonds with 2-10 year maturities. These bonds yield better returns compared to other European sovereign debt, and interest payments come twice a year.

Moventum takes a wider approach to fixed income. They provide access through diversified bond funds that include Portuguese sovereign debt among other European fixed-income instruments. This method gives better diversification but might reduce your exposure to Portugal-specific opportunities.

Tax-conscious investors should note that Utmost Apex structures their Portugal bond access with the Non-Habitual Resident (NHR) tax regime in mind. Their bond wrapper helps optimise tax efficiency for qualifying residents. Moventum's bond access doesn't have these Portugal-specific tax benefits, though they offer solid fixed-income options.

Fund and Portfolio Options

The range of investment vehicles is different between these platforms. Utmost Apex gives you access to:

Managed portfolio solutions with risk-profiled allocations

Discretionary investment management services

Multi-currency account structures supporting EUR, GBP, USD

Structured products with capital protection features

Moventum offers a self-directed approach with over 9,000 investment funds from more than 400 fund houses. Their fund universe covers equity, fixed income, alternative investments, and specialised sector funds. They focus on open architecture, which lets experienced investors customise their portfolios more than Utmost Apex.

Both platforms support model portfolios that line up with various risk profiles, from conservative to aggressive growth. All the same, Utmost Apex usually takes a guided investment approach with advisor oversight, while Moventum lets you make more independent investment decisions.

Minimum Investment Requirements

Entry thresholds show each platform's target demographics and business models. Utmost Apex aims at higher-value portfolios with minimum investments of €75,000 for basic investment bond structures. Their premium tiers, with better features and lower fees, start at €150,000.

Moventum keeps its entry barriers low with minimum investments of €10,000 for most account types. Regular contributions can be as low as €100 monthly, making the platform available to investors who want to build wealth step by step.

Bespoke Financial Advice For Expats In Portugal

Fixed Income Investor's experts understand what expats and HNWIs need and face. We can help create a custom investment portfolio that matches your goals and circumstances, whether you need wealth management, pension or succession planning.

These minimum thresholds reflect each platform's market position. Utmost Apex targets investors with large portfolios who want complete wealth structuring. Moventum appeals to more investors, including those just starting to build wealth.

Think over your current portfolio size, future investment goals, tax situation, and preference for direct control versus guided management when choosing a platform. Each platform's investment options show basic differences in philosophy that go beyond their product lists.

Investment Platform Fee Comparison

The true value of an investment platform lies in its fee structure. A full picture of costs shows key differences between Utmost Apex and Moventum that affect your returns over time.

Annual Platform Fees: Flat vs Tiered

These platforms follow two very different pricing approaches. Utmost Apex uses a tiered percentage fee that changes based on how much you invest. Portfolios between €75,000 and €150,000 pay annual platform fees of 1.0% to 1.5%. The percentage drops for larger investments – accounts over €500,000 can get rates as low as 0.4% to 0.7% per year.

Moventum takes a simpler path with a flat 0.4% annual fee, whatever your portfolio size. This works well for investors with bigger portfolios who would pay more under percentage-based fees. Your investment amount plays a vital role in how these fees stack up:

Smaller portfolios tend to do better with Moventum's pricing, while larger investments might save more with Utmost Apex's tiered system.

Transaction and Custody Charges

Transaction costs add another layer to your total expenses. Utmost Apex charges €15-€30 for each standard fund trade. These fees add up quickly if you trade often.

Moventum includes many fund transactions in their platform fee. They charge a separate 0.1% annual fee for custody and settlement. This setup can save money for investors who don't trade much.

Currency conversion rates also differ between platforms. Utmost Apex charges 0.75%-1%, while Moventum stays around 0.5%. This matters a lot when you invest across different currencies.

Regular monthly investors should know that Utmost Apex waives transaction fees on regular contributions. This can make it more affordable despite higher base fees.

Hidden Costs and Exit Fees

Less obvious costs can affect your returns significantly. Utmost Apex has early surrender charges starting at 8% in year one. These charges drop to zero after eight years. This matters if you might need your money sooner.

Utmost Apex's underlying fund charges range from 0.5% to 2.5% yearly based on your fund choices. These come on top of platform fees and can really push up your total costs.

Moventum has no early surrender charges.

Your investment style determines which platform costs less. Active traders often benefit from Utmost Apex's tiered structure and free regular contributions. Buy-and-hold investors can save money with Moventum's simple pricing that cuts out most transaction costs.

Performance and Return Potential

A look at investment returns shows key differences between these competing platforms. Your ground results depend on how each platform balances performance and risk, beyond just fees and what they offer.

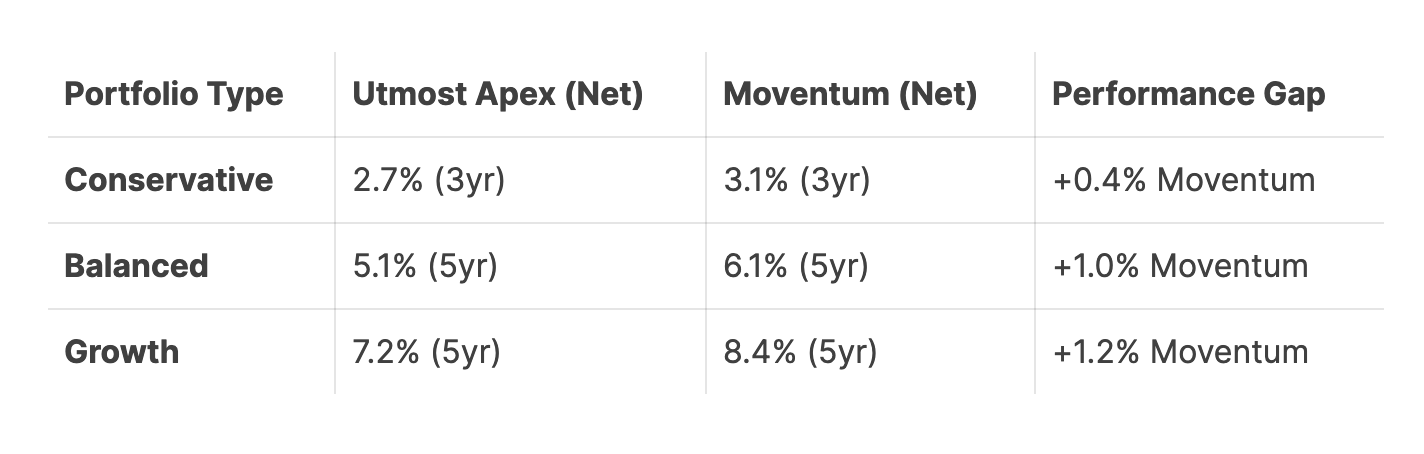

Historical Returns: 3-Year and 5-Year Averages

The performance data reveals clear patterns between Utmost Apex and Moventum portfolios. Balanced portfolios (60% equity/40% fixed income) from Utmost Apex have delivered 5-yearannualisedd returns between 5.2% and 6.8%, based on specific investment choices. Their Portugal bond portfolios have produced stable returns at 3.1% annually in the last five years.

Moventum's balanced portfolio options have achieved 5-year returns from 5.8% to 7.3%. They perform better because of their wider fund selection and lower fees. The gap closes for conservative portfolios that focus on protecting capital, with both platforms showing similar 3-year average returns between 2.9% and 3.5%.

The net performance difference becomes clearer after counting all platform and fund-level fees:

Risk-Adjusted Performance Metrics

Returns tell only part of the story. Risk-adjusted metrics give us better insights. Utmost Apex's balanced portfolios achieve Sharpe ratios (return per unit of risk) between 0.52 and 0.68. Their conservative Portugal bond options reach higher Sharpe ratios around 0.71, thanks to lower volatility despite modest returns.

Moventum portfolios have achieved Sharpe ratios from 0.59 to 0.74, showing better risk-adjusted performance. Their Sortino ratios (which measure downside risk) show an even bigger advantage, with numbers 0.15-0.20 points higher than similar Utmost Apex portfolios.

Two main factors drive Moventum's risk-efficiency edge: their lower fees keep more returns intact and their wider fund selection allows precise risk management.

User Experience and Support

Daily interactions with investment platforms shape how satisfied users feel about their investment journey beyond just the returns. Let's look at how Utmost Apex and Moventum stack up when it comes to their interfaces, getting started, and help desk support.

Platform Interface and Mobile Access

These platforms show their true colours through their digital interfaces. Utmost Apex gives you a sleek advisor-focused dashboard but keeps self-service options minimal. Their web portal works more as an info hub than a place to make trades. Users can check their investments, pull up statements, and track performance. Most changes need an advisor's help. The mobile experience issimple – just a responsive website instead of a proper app.

Moventum takes a different path with its self-service platform that lets users do more. The interface puts users in control – they can buy funds, adjust portfolios, and dive deeply into performance numbers without calling an advisor. Their mobile app packs almost everything the main platform has. Users can log in with fingerprints, make trades, and upload documents on the go.

Language options set these platforms apart too. Moventum speaks six languages (English, German, French, Spanish, Italian, and Portuguese). Utmost Apex sticks mainly to English with just a few other language options.

Onboarding Process and KYC

Getting started looks quite different on each platform. Utmost Apex maintains a traditional approach by using paper forms that require genuine signatures and certified ID documents.

Moventum puts digital first with a simplified online signup and electronic cheques. Most clients can access their online portal within 2-5 business days. Many users can verify their identity through video calls, which means no paper documents are needed in most cases.

Customer Support Responsiveness

Support shows what each platform values most. Utmost Apex gives personal relationship managers to clients with over €150,000 invested. These managers help during office hours. Smaller accounts get help from a central team. Big clients hear back the same day, while others might wait 24-48 hours.

Moventum runs support in tiers. Everyone gets email support, and accounts over €50,000 can call in too. They usually answer within 4-24 hours based on what you're asking. The platform stands out by helping users in multiple languages across all support channels.

Both platforms skip live chat for now, though Moventum plans to add this feature by late 2025.

Tax Efficiency and Legal Structure

Tax efficiency plays a bigger role than performance metrics when investors compare investment platforms. Your chosen platform's tax structure will affect your actual returns, whatever the headline figures suggest.

Tax Treatment for Portugal-Based Investors

Utmost Apex has designed its Portugal Bond to line up with Portugal's Non-Habitual Resident (NHR) tax regime. This structure lets qualifying residents get substantial tax advantages, which include lower taxes on foreign-source income. Portuguese tax residents might qualify for favourable treatment, which could lower certain income types' tax rates by 10%.

Moventum takes a more standard approach without any Portugal-specific tax benefits. Investors must handle their own tax compliance on this platform, which might not work well for people looking to get NHR benefits. If you'd like to learn more about financial planning as an expat in Portugal, book a free discovery call today.

Cross-Border Tax Implications

These platforms handle cross-border taxation in very different ways for mobile investors. Utmost Apex employs an insurance wrapper structure that makes tax reporting easier across jurisdictions. Many scenarios allow gains to compound through this "tax-deferred" growth model without immediate taxation.

Moventum's traditional investment account structure puts tax reporting duties right on the investor's shoulders. The platform creates annual tax statements that work with most European tax systems automatically. However, it lacks the cross-border tax advantages you'd find in insurance-based structures.

Legal Protections and Fund Segregation

Both platforms keep client assets separate from company operating funds through strict fund segregation. Utmost Apex follows Isle of Man regulations and protects investors through Life Assurance (Compensation of Policyholders) Regulations. This covers 90% of investor assets without any upper limit.

Luxembourg's investor protection scheme (SIIL) governs Moventum and covers up to €20,000 per investor. This difference matters a lot for larger portfolios where protection limits can affect overall security.

These structural differences between platforms end up creating unique tax profiles. Your residency status, investment amount, and cross-border needs will determine which platform works better for you.

Comparison Table

Conclusion

Your choice between Utmost Apex Portugal Bond and Moventum depends on your investment style and financial goals. These platforms serve different types of investors. Utmost Apex focuses on wealthy expatriates who can make larger investments and need personal service. Moventum works better for a wider range of investors with its lower entry requirements and do-it-yourself options.

Looking at performance, Moventum tends to deliver better risk-adjusted returns. Tax-conscious expatriates in Portugal might prefer Utmost Apex because it works well with the Non-Habitual Resident tax system.

Fixed Income Investor offers expert financial advice to expats in Portugal. Our team understands expats' and high-net-worth individuals' specific needs. They help create custom investment portfolios that match your goals, whether you need wealth management, pension planning, or succession planning.

The platforms' user experience differs greatly. Moventum gives you a detailed self-service platform, while Utmost Apex works through advisors. Your preference for hands-on satisfaction or guided management will influence your happiness with each platform.

Making the right choice means weighing what matters most to you – tax benefits, investment minimums, fees, control levels, and expected returns. Take time to evaluate your needs before choosing a platform. This careful consideration will benefit your investment future.