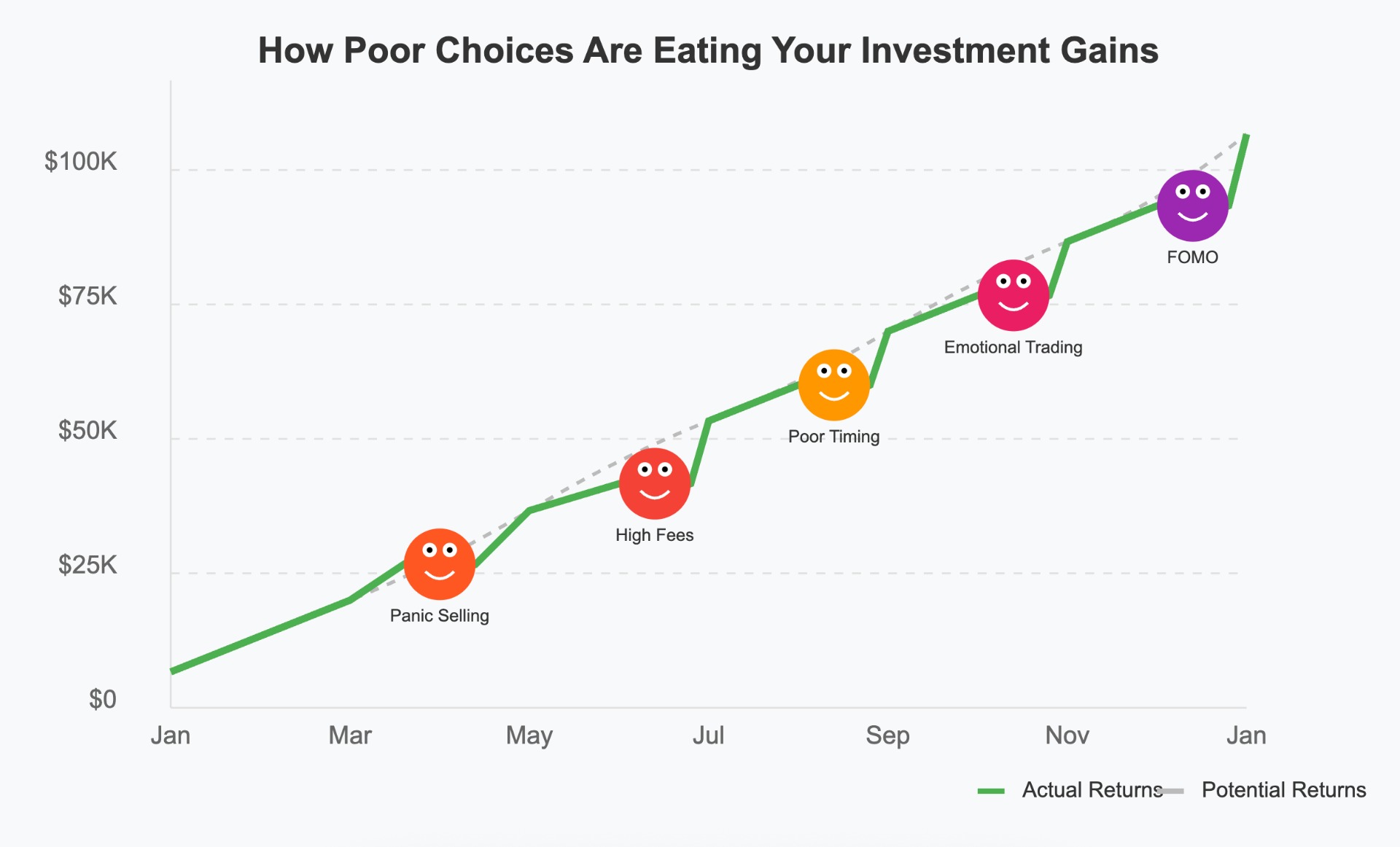

How Poor Choices Are Eating Your Investment Gains This Year

The data presents a compelling narrative. The MSCI World Index delivered annualised returns of 9.2% over the 10-year period until July 2025. Yet the average mutual fund investor earned just 2.54%. This significant discrepancy is not due to pure luck; investors often make preventable mistakes that result in significant losses.

Market returns typically range from 3% to 10% each year. Your portfolio might be underperforming by a lot due to common errors. These investment blunders can wipe out hundreds of thousands in returns over 20 years. To cite an instance, flat market periods with hidden fees of 3% annually can shrink your $100,000 portfolio to $70,000 – a brutal 30% drop.

Most investors keep making these mistakes that get pricey over time. They chase last year's top-performing funds, which almost always backfires. They skip global diversification, especially when you have smaller economies making up less than 1% of the global market. On top of that, 96% of actively managed mutual funds can't beat the market over 15 years. Still, many investors keep pursuing active management.

Let's take a closer look at the seven most harmful investing mistakes you might make in 2025 and how to protect your financial future by avoiding them.

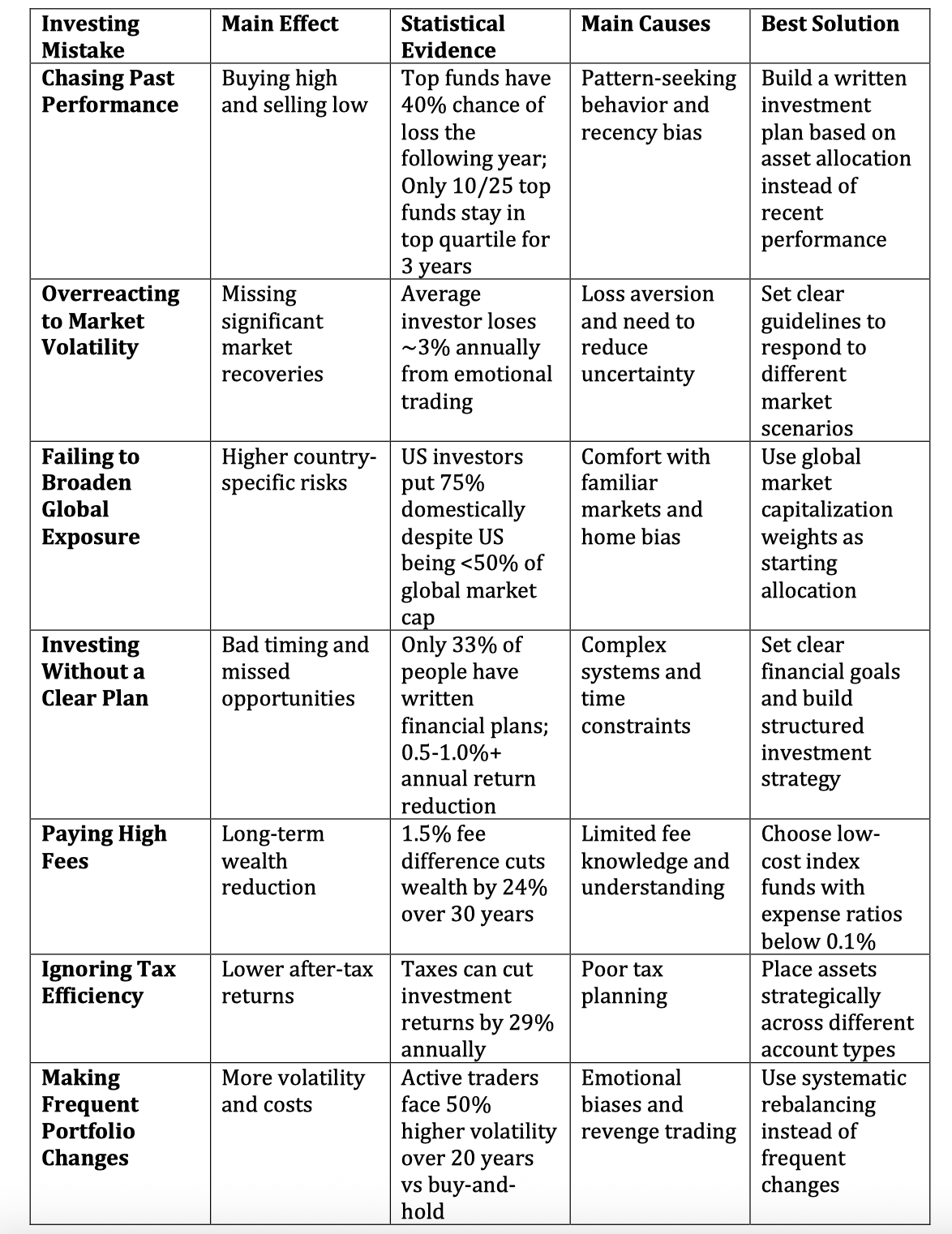

Chasing Past Performance

Performance chasing ranks among the biggest investing mistakes people make. You see a fund or stock deliver exceptional returns recently and feel tempted to invest right away. The desire to ride that wave of success feels natural. Notwithstanding that, this approach rarely works out well.

Chasing Past Performance Explained

Investors chase performance by picking investments based on their recent strong returns rather than doing fundamental analysis or following a long-term strategy. Let's take a closer look at 2023, when the "Magnificent 7" stocks (including companies like NVIDIA, Meta, Amazon, and Alphabet) soared 107% and drew in countless investors. These same investors tend to forget these stocks dropped 45% in 2022 while the S&P 500 fell only 18%.

Our psychological makeup drives this behaviour. The human brain tries to find patterns, even in random market movements. We also have recency bias that makes us favour newer information over older data. These two tendencies create ideal conditions for performance-chasing behaviour.

You can see this play out when investors move their money between "hot" mutual funds. They end up buying high and selling low—doing the exact opposite of successful investing.

Why Chasing Past Performance Hurts Your Returns

Chasing performance instead of adhering to a consistent strategy negatively impacts your long-term returns. The average investor return lags behind the very funds they bought and sold—clear proof that investors make poor timing decisions.

The numbers clearly demonstrate that outperformance is rarely sustained. There is no meaningful relationship between past and future fund performance. Top-performing funds face a 40% chance of losing money the next year, while randomly chosen asset classes only have a 27% risk.

This pattern shows up across markets. The most successful equity funds over 10 years revealed:

Only 10 of 25 top funds stayed in the top quartile for three straight years

Just 4 funds reached four consecutive years of top-quartile performance

Every top fund dropped to the third quartile at least once

These top funds spent only 43% of their time in the top quartile

Several factors explain this pattern:

Mean reversion – Outperforming investments tend to normalize while underperforming ones improve

Market cycle changes – Different market conditions favor different investment styles

Valuation impact – Warren Buffett put it best: "you can turn any investment into a bad deal by paying too much."

Manager changes – New fund managers can completely change investment philosophy and execution

So investors who jump between hot investments often miss the recovery of the ones they left behind.

How to Avoid Chasing Past Performance

These approaches work better than focusing on past performance:

Create a written investment plan: Choose your portfolio's asset allocation first, then pick investments based on these targets rather than recent performance.

Get into fund consistency: Look beyond the headline numbers at year-by-year performance across market conditions. See how a fund behaves in both good and bad markets to understand its true nature.

Focus on low costs: Low expenses predict future performance better than anything else among similar funds. Studies show cheaper funds perform better long-term since high recurring costs don't hold them back.

Think long-term: A "Performance Chaser" portfolio—investing in last year's best fund—falls 36% behind a consistent strategy. Patient investors with million-dollar portfolios earn an extra €1,128,290 by avoiding performance chasing.

Go for broad diversification: Rather than trying to pick winners, buy "the haystack" through broad index funds. This removes the urge to chase performance.

Warren Buffett said it best: "The investor of today does not profit from yesterday's growth." Investing success comes from staying patient and disciplined instead of running after yesterday's winners.

Overreacting to Market Volatility

Market volatility triggers strong emotional responses, which can result in costly investment decisions. Even seasoned investors make impulsive choices during rocky markets. This behavioural pattern consistently hurts long-term earnings.

Overreacting to Market Volatility Explained

Investors overreact by making dramatic portfolio changes based on short-term market movements instead of sticking to their long-term strategy. This behaviour shows up in two common scenarios: panic selling during downturns and impulsive buying during rallies.

Both positive and negative events tend to cause stocks to overreact, with negative events having a greater impact. The overreaction gets stronger during periods of clustered extreme market swings, showing a clear link between market volatility and investor overreaction.

The psychology behind this tendency is straightforward – humans are "uncertainty reduction" machines. Market turbulence triggers our instinctive reaction to do something, anything, to reduce uncertainty's discomfort. We also feel the pain of losses about 2.5 times more intensely than the pleasure of equivalent gains.

Why Emotional Investing Damages Returns

Emotional investing significantly strains financial resources. The average equity mutual fund investor loses roughly 3% in returns each year just from overreactive buying and selling. This performance gap grows dramatically over time.

The damage follows predictable patterns:

Investors often buy at high prices and sell at low prices due to fear, which pushes them to sell in order to avoid further losses. During rallies, greed and FOMO (fear of missing out) drive buying at high prices.

Missing market recoveries – The markets bounce back faster and more unexpectedly than most realise. Investors who exit during downturns typically miss these vital recovery periods.

Excessive trading costs – Regular portfolio changes rack up transaction costs and potential tax hits that eat into returns.

The damage hits harder during high market volatility. Mispricing grows much stronger when investor sentiment turns negative rather than positive.

How to Stay Calm During Market Swings

Market volatility requires preparation and discipline to navigate successfully:

Build a thoughtful investment plan – create a written investment strategy that matches your time horizon and risk tolerance before volatility strikes. This gives you a solid framework for decisions during emotional periods.

Keep proper perspective – market ups and downs are normal. U.S. equities have averaged a 14% intra-year drop since 1980. Yet stocks have never lost money over any 15-year period in the past 50 years.

Design a volatility response plan – write down specific actions for different market scenarios (e.g., "A 10% market drop means rebalancing but not selling"). Clear guidelines prevent snap decisions.

Cut back on media —reduce your exposure to financial news during volatile times. Alarming headlines often trigger unnecessary anxiety.

Look at your timeline —short-term volatility matters less for long-term goals. Temporary market declines mean little if you don't need the money for years.

Build cash reserves —a solid emergency fund separate from investments provides peace of mind during market turmoil. This makes staying invested easier.

Talk to an advisor —financial professionals offer objective views during emotional market periods. They help separate rational choices from emotional reactions.

Although it can be emotionally challenging, maintaining investments during market volatility provides diversified portfolios with the best chance of achieving their goals. Aside from major life changes, it rarely makes sense to change your core investment strategy based solely on market movements.

Failing to Diversify Globally

Image Source: Investopedia

Home bias stands out as one of the biggest investing mistakes in 2025. Investors put too much of their money into their local markets. They don't realise how this choice limits their long-term returns.

The Problem with Staying Local

Putting your money in different geographic regions, industries, and asset classes worldwide creates a balanced investment approach. Most investors show strong "home bias" and put too much money in their local markets. To cite an instance, US investors typically put 75% of their stock investments in US markets, though the US makes up less than 50% of the world's market value. This pattern shows up everywhere, as investors in most countries prefer their local assets.

People make this choice because they know local companies better and feel safer with domestic investments. Local market information is also easier to find. This comfort zone comes at a high price for your investment returns and risk management.

The Value of Going Global

Going global with your investments brings vital benefits that affect your success:

Better Balance Through Non-Correlation: Countries often have different economic cycles. Some regions grow while others slow down, which helps balance your portfolio's performance. Your returns become more stable over time.

Safety from Local Market Problems: A global portfolio protects you when one country faces political problems, economic troubles, or industry downturns. Japan's market crash in the 1980s teaches us an important lesson—the MSCI Japan Index hasn't reached its 1989 peaks in local currency, hurting investors who kept too much money at home.

More Ways to Grow: Global investing lets you tap into growth you can't find at home. Each region has its strengths—state-of-the-art technology in Asia or natural resources in Latin America. Staying in one country means missing good investments elsewhere.

Protection Through Different Currencies: Having investments in various currencies helps protect against currency risk and inflation at home. When Brexit caused the British pound to drop, UK investors who went global saw their dollar and euro investments rise.

How you split your investments matters most for your returns over time. Market leaders change each decade—today's winners might not lead in the 2030s.

Building Your Global Portfolio

Here's how to create a balanced global portfolio:

Look at Global Market Size: Start with how big each market is worldwide, then adjust for your needs. This keeps you from putting too much in any one country.

Think About Currency Protection: Currency changes make international bonds more volatile, so protecting against currency risk makes sense here. For stocks, exposure to different currencies often helps spread risk.

Keep Costs Low: Buy broad-based ETFs or index funds that follow trusted indices like the MSCI World Index or the MSCI All-Country World Index (ACWI). These give you instant access to thousands of companies worldwide.

Don't Overdo It: While spreading investments helps, too much can water down returns. Choose quality over quantity and aim for good balance.

Stay on Track: Markets perform differently over time, which changes your mix of investments. Regular adjustments help maintain your target balance.

Note that going global doesn't need to be complex. A simple portfolio with the right international mix often beats complicated approaches.

Investing Without a Clear Plan

Most investors rush into the market without a roadmap to guide their investment trip. This basic mistake can hurt their long-term success. Only 33% of people have a written financial plan. The reasons vary among those who don't: 42% think they don't have enough money, 22% find it too complex, and 19% say they lack time.

What It Means to Invest Without a Plan

Making financial decisions without clear objectives or strategy defines investing without a plan. People buy investments on impulse, chase market trends, or invest just to save taxes without thinking about the actual purpose. These investors only look at potential returns and ignore their risk tolerance or investment timeframe.

Investing without a plan resembles starting a race without knowing the finish line. These investors lack direction and keep changing strategies, which increases their chances of failure.

Why Lack of Planning Eats Your Returns

Unplanned investing negatively impacts your returns in several ways. Behavioural investment mistakes can cut returns by 0.5% to 1.0%+ each year. This gap grows significantly over time.

The financial impact of planless investing includes:

Investors miss opportunities because they don't know about potential investment options. A lack of strategic diversification exposes them to unnecessary risks. Poor diversification can lead to permanent losses exceeding 25%.

Cash buildup creates another issue. Without a solid plan for monthly investments, money sits idle in low-yield accounts. This stagnant cash loses value to inflation, reducing purchasing power steadily.

The biggest problem lies with impulsive decisions based on market noise instead of following a long-term strategy. Bad timing results in buying high and selling low – exactly what successful investors avoid.

How to Create a Solid Investment Plan

A good investment plan needs these key steps:

Assess your current financial situation: List your income, expenses, assets, and liabilities. Your net worth comes from subtracting debts from assets, helping you figure out how much you can invest.

Define clear financial goals: Document your short-term (0-2 years), medium-term (3-5 years), and long-term (5+ years) goals. Each goal needs a specific amount and timeline.

Understand your risk tolerance: Be realistic about the risk you can handle given your finances. Your risk comfort level, timeline, and goals should align with your investment choices.

Determine your asset allocation: Your goals and risk tolerance help decide how to spread investments across different asset classes. Short-term goals might need safer options like savings accounts or government bonds, while longer-term goals could benefit from stocks.

Monitor and rebalance regularly: Review your investments to check their performance. Market changes can affect your portfolio's risk level, making rebalancing essential.

A well-laid-out investment plan offers many benefits: better financial confidence, improved saving habits, and smarter risk management. The plan's greatest value lies in providing discipline during market turmoil, helping you avoid emotional decisions mentioned earlier in this piece.

The best investment plan remains one you really understand and can follow, even in tough market conditions.

Paying Excessive Fees

Image Source: Investopedia

Investment fees quietly eat away at wealth as time passes. These fees are often overlooked, yet they play a vital role in investing. Small percentage changes can reduce your returns because compound interest works against you.

Understanding Investment Fees

Your returns get sliced up by different types of investment fees. Portfolio managers charge management fees between 0.25% and 1% yearly. Mutual funds and ETFs need money to operate – their expense ratios range from 0.1% for index funds to more than 1% for actively managed funds. You might also pay:

Trading fees to buy or sell investments

Load fees (up to 5.75%) on mutual fund transactions

Advisory fees (0.25% to 1% yearly) for portfolio management

Hedge fund performance fees (typically "2 and 20" structure)

Account maintenance fees ($25-$100 yearly)

Many investors don't notice these costs until they've already taken a big bite out of their wealth. Every dollar that goes to fees is money that can't grow in your portfolio.

How High Fees Reduce Long-Term Gains

Fees can take a huge toll on your money. Let's look at two scenarios with $100,000 invested at 8% yearly for 30 years: a 0.5% fee leaves you with $761,225, while a 2% fee results in only $574,349—that's $187,000 less. This shows how a tiny 1.5% fee difference can cost you 24% of your potential wealth.

Fees, one-time charges, and inflation reduce investment returns by 29% on average. Retail investors lose even more at 21%, compared to institutional investors at 13%.

Different investments face varying fee impacts. Passive equity funds lose 11% to fees, while retail bond mutual funds lose up to 44%. This difference matters a lot when choosing investments.

How to Minimize Investment Costs

Here are some practical ways to cut your investment costs:

Low-cost index funds and ETFs should be your first choice, with expense ratios under 0.1%. These passive options have beaten most actively managed funds after fees.

Stay away from funds that charge front-end loads or deferred sales charges – they can take up to 5.75% of your money right away. No-load mutual funds offer a better deal without these extra charges.

Moving all your accounts to one provider might help you tap into lower-cost tiers and reduce expenses. This makes managing your portfolio easier and cheaper.

Check your investments' fee structures regularly. Fee calculators help you find affordable options by showing long-term costs based on your portfolio size. Small changes today can grow into big savings later.

Note that keeping costs low lets more of your money work for you. This improves your portfolio's performance and helps it weather market ups and downs better.

Ignoring Tax Efficiency

Many investors overlook tax implications. Your hard-earned returns can take a substantial hit if you don't think about the tax effects of your investment decisions. Your financial goals depend on understanding when and how taxes apply to your investments.

What Is Tax-Efficient Investing?

Tax-efficient investing helps you maximise returns while keeping tax liabilities low through strategic investment and account choices. Just as with chess, you need to plan several moves ahead. The right mix of taxable and tax-advantaged products will help keep more money working for you. The goal isn't just about generating strong returns – it's about keeping as much of those returns as possible.

How Taxes Can Erode Your Returns

Taxes can significantly impact your investment performance. They reduce investment returns by 29% on average each year. This puts your long-term financial security at risk, especially if you're saving for retirement.

Here's how different investments trigger tax events:

Capital gains taxes (0-20% plus potential 3.8% net investment income tax) on investment profits

Ordinary income taxes (up to 37%) on interest payments and non-qualified dividends

Dividend taxes at preferential rates for qualified dividends

Your portfolio's compound growth suffers from these ongoing tax hits. Money paid in taxes can't grow in your portfolio.

Strategies to Improve Tax Efficiency

Here are proven ways to reduce your investment's tax drag:

Place tax-inefficient investments (like bonds or high-turnover funds) in tax-advantaged accounts. Keep tax-efficient investments (such as index funds or municipal bonds) in taxable accounts.

Tax-loss harvesting helps offset capital gains with losses. This strategy could reduce your tax bill by up to €2,862.63 of ordinary income yearly.

Hold your investments longer than one year. This qualifies you for lower long-term capital gains rates instead of higher ordinary income rates.

Make the most of tax-advantaged accounts.

Smart tax management should complement your investment strategy. It plays a vital role in your investment decisions.

Making Frequent Portfolio Changes

Many portfolios suffer damage when investors compulsively buy and sell investments, often without noticing the harm.

Why Frequent Portfolio Changes Are Risky

Several mechanisms make frequent portfolio changes hurt long-term success. Near-perfect foresight becomes essential to succeed consistently in market timing. You need to be right twice every time—knowing the perfect exit point and re-entry point. On top of that, it takes just a few missed days of concentrated market gains to substantially lower your portfolio's performance.

Market timing isn't the only challenge. A trader's psychology can trigger overtrading. Losses often push traders to make bigger and more frequent trades. They try to "recoup capital" or get "revenge" on the market. This mindset, combined with confirmation bias, makes them decide on trades first and look for technical justification later.

The Cost of Overtrading

Frequent trading can lead to significant financial losses. The S&P 500 delivered over 10% returns between 1994 and 2025, but the average investor's results were nowhere near as good. We blamed those declines mainly on over-trading and poor market timing decisions.

These costs add up quickly:

Transaction costs and taxes eat into returns with every trade

Tax headwinds create long-lasting damage— a low-turnover portfolio's after-tax returns reached 8.8% yearly compared to just 6.3% for high-turnover portfolios

Opportunity costs stack up from missing typical market rebounds after downturns

Active traders face almost 50% higher volatility over 20 years than buy-and-hold investors—and 71% more over 30 years.

How to Maintain a Long-Term Strategy

Clear rules about making changes help avoid this expensive investing mistake. Strong market periods offer good times to rebalance systematically, which helps prevent selling at bad times. Traders who stick to strict position size management usually do better, whatever their system or timeframe.

Note that Warren Buffett's wisdom about chances rings true: "If I get an idea next week, I'll do something. If not, I won't do a thing". "Time in the market is more important than timing the market".

Comparison Table

Conclusion

These seven investing mistakes look obvious on paper, but most investors still make them. This significantly reduces their investment returns over time. The combined effect explains why average investors earn much less than market indices. You can improve your investment outcomes by spotting these pitfalls early.

A detailed investment plan works better than chasing past performance or making emotional reactions to market swings. Your plan should include global diversification, tax-efficient strategies, and low-cost investment vehicles. Market turbulence tests your resolve, but adhering to your strategy helps you avoid costly impulse decisions.

Successful investors don't win by picking perfect stocks or timing the market just right. Their success comes from avoiding basic mistakes while keeping a long-term viewpoint. Simple improvements in your investment approach can accumulate significantly over decades.

You don't have to handle your investment experience alone. We can help you manage your money and avoid these costly investing mistakes. Please reach out to schedule a meeting with us today!

Investment success needs patience and discipline. Markets will swing up and down. Financial media will push the latest trends. Your emotions will pull you toward snap decisions. Your biggest edge isn't in complex strategies. It comes by steering clear of these seven wealth-destroying mistakes that most investors repeat year after year.