Singapore vs UK Cost of Living: What £1000 Gets You in 2025

Living in Singapore is pricier than in the UK. The overall living expenses in Singapore are a staggering 32.7% more than in the United Kingdom. People choosing between these destinations need to understand what their money can buy to plan their finances better.

The numbers paint a clear picture. Singapore's total living expenses, including rent, climb 37.1% above UK levels. This gap affects daily expenses from your home to getting around. Singapore's rental prices are 55.9% higher than UK rates, making housing your biggest expense. The bright side emerges if you compare it with London – Singapore turns out to be 18% cheaper than the British capital. Your monthly budget needs careful planning whether you stay short-term or relocate permanently. Life in Singapore costs about £10,634 (SGD $18,251) to match a £13,000 London lifestyle.

Fixed Income Investor shows exactly what £1000 buys you in both countries. We break down housing, food, transportation, utilities, and entertainment costs in 2025 to help you plan your move smartly.

Housing and Rent: How Far £1000 Goes

Housing takes the biggest chunk of your expenses when you look at Singapore versus UK living costs. Your £1000 goes a lot further in one country than the other, especially in the rental market.

1-Bedroom Rent: City Center vs Suburbs

A one-bedroom apartment in Singapore's city centre costs about S$3,970 (£2,296) per month. London gives you better value at S$3,761 (£2,175). The suburbs tell a similar story – Singapore apartments outside the city centre average S$2,976 (£1,721), while London suburbs cost S$2,934 (£1,697).

Your £1000 won't even cover half a month's rent for a central Singapore apartment. The rental prices in the city-state can be 210.1% higher than similar UK properties. This makes budget planning vital.

Shared Accommodation Options in Both Countries

The high costs push many people toward shared living. Singapore's flatsharing platforms like Homates and Roomies list rooms starting at US$668 monthly. UK flat-shares range from £554 to £1,600 per month.

Singapore's government housing (HDB flats) gives you more affordable options, from snug one-bedroom units to roomy three-bedders. Expats who want luxury but need roommates often find better value in condominium sharing than renting alone.

Average Cost of Living Singapore: Rent Breakdown

Housing eats up much of your monthly budget in Singapore. Students living off-campus pay around S$525 monthly. UK students shell out more at £408 (S$669).

Recent data shows a single person in Singapore spends S$3,482 on rent. That's about 71% of their S$4,899 monthly expenses. Families face higher housing costs – rent takes up 58% of their S$12,000 monthly budget.

Cost of Living Singapore vs London: Property Prices

Property buyers face different numbers than renters in Singapore and London. Singapore's city centre property costs S$2,693 (£1,557) per square foot, about 8% more than London's S$2,476 (£1,432).

The gap widens in the suburbs. Singapore properties cost S$1,852 per square foot (£1,071). London suburban properties are cheaper at S$1,355 (£784)—that's a 27% difference.

Knight Frank's data shows that US$1 million bought just 32 square meters of prime Singapore real estate. This puts Singapore among the world's priciest property markets, right up there with London.

Food and Groceries: Eating on a Budget

Food costs tell a fascinating tale between Singapore and the UK. The price differences paint an intriguing picture both in grocery shopping and eating out.

Grocery Basket: Singapore vs UK

The same products appear on shelves in both countries, but Singapore's grocery prices run 30.5% higher than the UK's. This comes as no surprise since Singapore imports over 90% of its food from more than 170 countries. The simple groceries show clear price gaps:

Milk (1 liter): S$3.86 (£2.23) in Singapore vs S$2.16 (£1.25) in the UK – 44.1% higher

Bread (500g): S$3.08 (£1.78) in Singapore vs S$2.15 (£1.24) in the UK – 30.4% higher

Chicken filets (1 kg): S$14.68 (£8.49) in Singapore vs S$11.45 (£6.62) in the UK – 22% higher

Rice (1 kg): S$3.48 (£2.01) in Singapore vs S$2.82 (£1.63) in the UK – 18.7% higher

Notwithstanding that, UK shoppers pay 30.1% more for tomatoes than their Singapore counterparts. This shows how prices can vary by product.

Dining Out: Hawker Centers vs Pubs

The dining scene presents a distinct narrative. Singapore's hawker centres give much better value than UK restaurants. A meal at an inexpensive restaurant costs around S$12 (£6.94) in Singapore, compared to S$25.93 (£15) in the UK – that's 116.1% more.

Singapore's hawker centres serve full meals for as little as S$2.86-5 (£1.65-2.89). These government-run food hubs span 121 locations nationwide and offer specialised dishes for various ethnic groups. British pubs and casual dining spots usually charge £10–20 per meal.

Monthly Food Budget: What £1000 Covers

A £1000 budget (about S$1,730) goes much further for eating out in Singapore but not so much for home cooking. Here's how a typical monthly food budget looks:

Singapore: S$553.44 (£338) for prepared food plus S$130.73 (£80) for groceries

UK: £360 (S$589.70) for prepared food plus £28 (S$45.80) for groceries

A budget-conscious couple in Singapore might spend between S$572.53-954.20 (£330-552) monthly. This includes breakfast and dinner at home, lunch at food courts, and weekend outings.

Imported vs Local Food Costs

Singapore's heavy reliance on imports reshapes the scene of food prices. Food inflation peaked at 8.1% in February 2023 but has dropped to 1%. Local farms produce less than 10% of Singapore's food needs, though the country aims to reach 30% by 2030.

Singapore's consumers prefer local products, and with good reason too. About 75% keep taking local eggs, while 69% buy local vegetables. The top reasons for preferring local products are freshness, safety standards, and support for local farmers, despite the fact that imported options often have a lower cost.

Transportation and Daily Commute

Transportation expenses in Singapore and the UK reflect entirely different approaches to urban mobility, which will impact your monthly budget in distinct ways.

Public Transport Passes: MRT vs UK Railcard

Singapore's public transport network gives you better value than the UK. Train and bus fares for adults in Singapore cost between S$1.04 and S$2.26 (£0.60 to £1.31). These rates are nowhere near London's £1.90 to £5.60 (S$3.29 to S$9.69) for trains and flat £1.75 (S$3.03) for buses. Regular commuters can buy Singapore's Adult Monthly Travel Pass at S$122.14 (£70.73). This pass lets you take unlimited trips on all simple bus and train services.

Singapore keeps public transport affordable through heavy subsidies, unlike the UK system. Adult commuters in Singapore spend about €42.94 (£36.27) monthly. Heavy users without a monthly pass would pay around €133.59 (£112.82) each month.

Taxi and Ride-Hailing Costs

Each country's taxi services come with their own pricing models:

Singapore taxis: Starting fare S$2.86-3.40 (£1.66-1.97), plus S$0.21 (£0.12) per 400m up to 10km

Singapore airport to city center: S$26.06 (£15.09)

UK taxis: Higher fares overall, with London black cabs ranking among the world's priciest

Singapore stands at 20th place among the world's cheapest cities for taxi fares. Ride-hailing apps like Grab and Gojek often cost less during off-peak hours. A 3 km taxi ride in Singapore costs about US$3.83 (£3.01).

Fuel and Car Ownership: A Luxury or Necessity?

The Certificate of Entitlement (COE) system in Singapore drives up car prices significantly. A Toyota Camry Hybrid costs S$238,552 (£138,187) in Singapore—six times more than in the US. The COE alone for a large family car has hit S$139,316 (£80,675). These prices put car ownership out of reach for most people.

Fuel costs more in Singapore at €2.20 (£1.86) per litre compared to the UK's €1.94 (£1.64). This adds to the already high ownership costs.

Monthly Cost of Living Singapore: Transport Share

Public transport remains the go-to choice for 82.66% of Singaporeans who use it daily. A typical month with 20 workdays costs about S$76.34 (£44.21) in commuting expenses. This expenditure constitutes a small part of Singapore's average monthly living expenses.

A £1000 budget easily covers all your transport needs in Singapore and leaves you with plenty to spare. Housing takes up much more of your monthly expenses.

Utilities, Internet, and Mobile Plans

Basic utilities are the foundations of monthly expenses in Singapore and the UK. Each country has its own pricing structure that reflects local conditions.

Electricity and Water Bills: Climate Impact

An 85m² apartment in Singapore costs around £122 for monthly utilities. UK residents pay almost double at £239—a 96.2% difference. This huge gap exists because Singapore's tropical climate needs air conditioning all year round, which drives up electricity use. Air conditioning takes up much of Singapore's utility bills, and electricity costs about £0.29 per kWh.

Singapore's carbon tax also pushes utility prices up. A £23.86 per tonne emissions tax adds about £3.82 to monthly bills for residents in four-room HDB flats. Household expenses will rise as this tax increases over time.

Internet and Mobile: Cost and Speed Comparison

These nations show clear differences in internet connectivity. British consumers pay £31 for fibre-optic broadband with 60 Mbps or more speeds, while Singapore residents pay £27—a 16.4% difference. Singapore's home broadband plans cost between £28.63 and £66.79 monthly based on speed. Most people choose fibre-optic connections at 1 Gbps.

We find that mobile data costs reveal an intriguing pattern. Singapore leads the world in mobile data affordability. Its residents spend just 0.35% of their average salary on mobile plans. The UK ranks fifth at 0.52%. Yet both countries charge about £13 for monthly plans with 10GB+ data.

Bundled Services and Promotions

Both countries offer great bundle deals for utilities. Singapore providers Singtel, StarHub, and M1 combine internet, mobile, and TV services. These packages save money compared to buying services separately. UK providers like UW market themselves as "the cheapest energy provider for variable energy tariffs" with bundled services.

Singapore residents can cut utility costs by comparing providers through the Open Electricity Market. They can track usage through provider apps and use cashback platforms like Shopback and Fave. UK residents get budget-friendly options through companies that offer combined billing services.

Entertainment, Fitness, and Lifestyle

Singapore and the UK show intriguing differences in their leisure and recreational expenses. These differences tell us a lot about lifestyle priorities and living expenses in each country.

Gym Memberships and Sports Facilities

Singapore's gym memberships cost much more than those in the UK. Monthly memberships in Singapore range from S$95.42 to S$143.13 (£55-£83). Premium facilities cost even more at S$190.84 (£110). UK fitness clubs are cheaper at £34.12-£49 (S$59.68-S$85). Singapore's prices are 120% higher than the UK's. Budget options exist in Singapore through government-run ActiveSG gyms that charge S$2.39 per entry or S$14.31 monthly.

Cinema, Clubs, and Dining Out

Entertainment costs between these countries are more similar. Singapore's movie tickets cost S$10.50-S$15.27 (£6-£9), while UK tickets range from £7 to £10. Cocktails at Singapore's upscale bars cost S$20.99-S$28.63 (£12-£16.50) [261], matching UK prices of £8-£17.

Restaurant prices show some differences. Singapore meals average S$38.17 (£22) per person, and UK restaurants charge about £25 . Theatre lovers pay more in Singapore, with tickets costing 62% more than London prices.

Streaming Services and Subscriptions

Digital entertainment costs stay similar in both countries. Netflix in Singapore costs S$13.34 (£7.72) monthly, Disney+ charges S$12.39 (£7.17), and Amazon Prime Video offers a cheaper option at S$2.85 (£1.65). These prices match UK rates, and both countries get similar content libraries.

How Much Leisure £1000 Buys Monthly

A £1000 budget typically includes S$55.34 (£32) monthly for entertainment in Singapore compared to £40 (S$64.89) in the UK. This covers movie outings, dining, and streaming subscriptions. Your £1000 can easily cover regular leisure activities and living expenses, even with Singapore's higher gym costs.

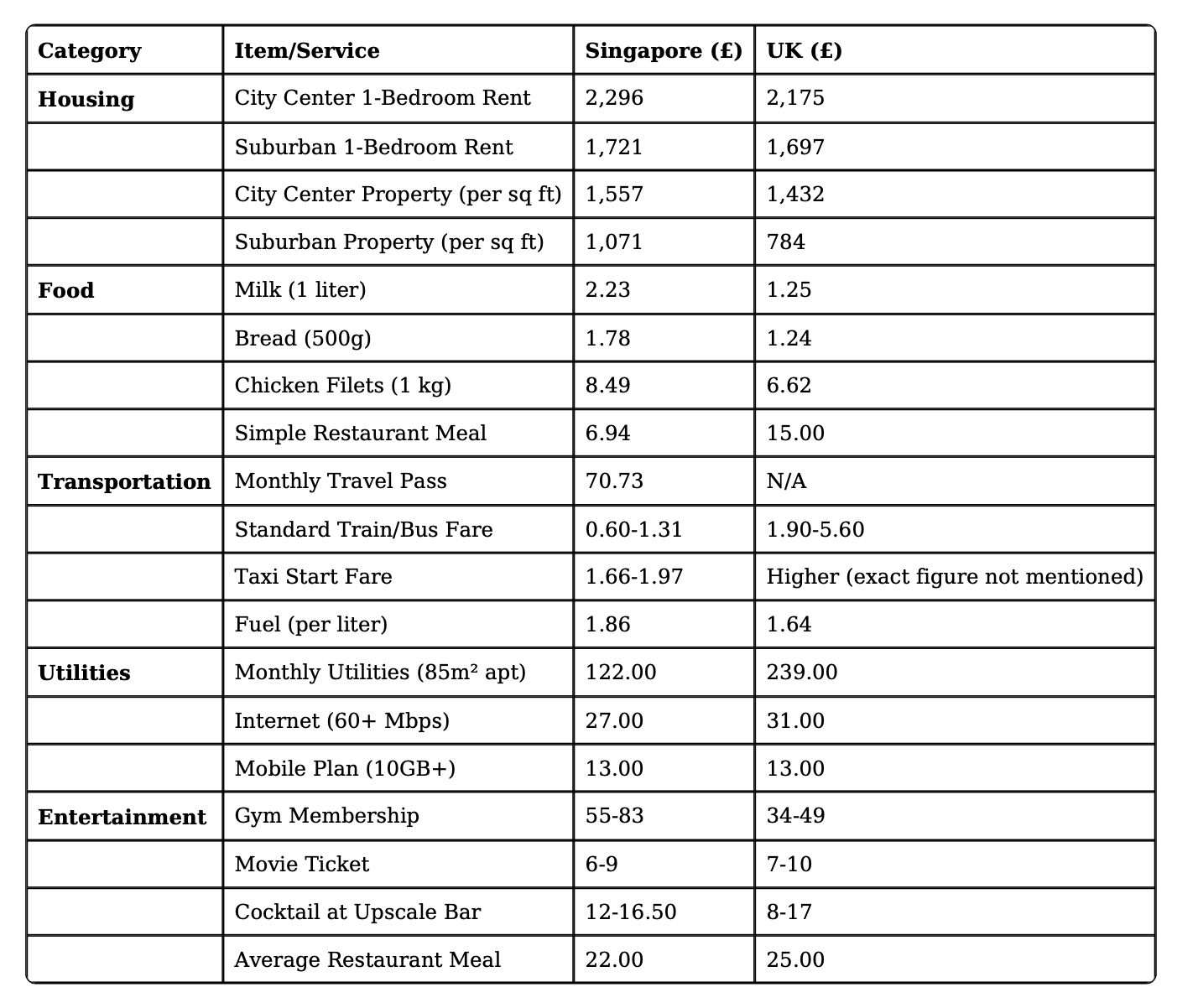

Comparison Table

Conclusion

Life in Singapore costs about a third more than in the UK – the sort of thing I love to analyse when people ask about moving between these countries. The cost of housing is particularly high in Singapore, with prices rising by 55.9% compared to UK levels. Is your budget of £1000 sufficient? It won't get you far in Singapore's central areas, where it barely covers two weeks of rent.

The food situation tells an intriguing story. Singapore's grocery bills run 30.5% higher, but eating out can be a bargain. Local hawker centres serve meals at prices that make British restaurants look expensive. Getting around shows similar contrasts. Singapore's public transport is a real bargain compared to UK prices. Just don't plan on buying a car there – the COE system makes it a luxury few can afford.

Here's a surprise: UK residents pay double what Singaporeans do for utilities, even with all those air conditioners running in the tropical heat. Entertainment costs are relatively similar between both countries; however, gym memberships in Singapore tend to be expensive.

Your £1000 needs careful planning based on your priorities. Singles might find Singapore's steep housing costs balanced out by cheaper transport and food. Families face bigger hurdles in making their budgets work.

The tax picture looks different too. Singapore's resident tax rates run from 0% to 22%, while the UK takes 20% to 45% of your income. These rates are a big deal, as they mean that your long-term savings and retirement plans need different approaches.

Are you looking to explore how your budget could function in either location? We're here to help crunch those numbers with you.

Both places have their strong points. Singapore may cost more for housing and some lifestyle choices, but its strong infrastructure, safety record, and Asian hub status create excellent opportunities. The UK shines with cheaper housing outside London, deep cultural roots, and clear paths to settling permanently. Your £1000 will stretch differently in each place – it's not about finding the cheaper option but matching your lifestyle, career prospects, and financial goals to the right location.