The Best Way for Expats to Make Their Money Work Smarter

As an expat, your hard-earned wealth may be steadily depleted by investment fees. Life abroad brings exciting opportunities but creates unique financial challenges that affect your long-term prosperity. Your investment fees will likely be higher than what residents pay while managing money across borders.

The complex world of investment fees becomes trickier with multiple currencies and international tax obligations. Smart strategies can help you grow your money and keep costs down. A full picture of investment fees across platforms shows substantial savings that many expats miss. Your financial future depends on making your money work smarter, whether you're an experienced expat or starting your international experience.

Why Expats Need a Smarter Financial Strategy

Managing money as an expat comes with challenges that go beyond regular financial planning back home. You'll need specialised strategies when you balance your finances across countries.

Unique financial challenges faced abroad

Life in another country means you must deal with multiple tax systems at once. You might face issues with double taxation, complex tax reports, and extra investment fees that locals don't have to worry about. Most expats also struggle with:

Having bank accounts in multiple countries

Following tax rules in both host and home countries

Finding financial advisors who know about cross-border money matters

The rules are different from country to country. This creates extra work that can affect your investment returns if you don't handle it right.

Currency fluctuations and cost of living differences

Your money's value depends on exchange rates that can change overnight. A 10% shift in currency rates could increase your investment fees or reduce your returns without any warning.

Living costs vary between where you earn and where you spend. Housing, healthcare, and education costs are often significant because they differ from what you expected based on your home country. So your investment plan must factor in these location differences to keep your lifestyle intact.

Lack of access to local financial products

Being a non-resident means you can't use many financial services that locals take for granted. Banks often limit account options for foreigners, and investment platforms might just say no to non-residents.

This limited access affects investment choices too, and expats usually pay higher rates. You might not be able to use pension plans, tax-saving accounts, or certain investments. This forces you to look for other options that often cost more or offer fewer benefits.

Your status as an expat means you just need a financial strategy that tackles these specific challenges while making the most of opportunities that come with living internationally.

Best Investment Options for Expats

Growing your wealth while living abroad depends on picking the right investment options. Good research helps you find ways to keep fees low and returns high, no matter where you live.

1. Offshore investment accounts

Offshore accounts give you tax benefits and protect your assets better than local market options. These accounts work best in stable places like Luxembourg or the Isle of Man and let you invest in multiple currencies. The fees on offshore platforms are lower than traditional banks, especially for bigger portfolios. Look at account fees, trading costs, and currency conversion rates to pick the best offshore provider.

2. International mutual funds and ETFs

Global investments help spread risk across markets instead of putting all your money in one economy. ETFs are a better deal than actively managed funds because their fees are lower—usually under 0.5%. These tools help maintain your money's value across currencies and let you invest in growing markets that might do better than your home country.

3. Real estate in stable markets

Buying property in countries with stable politics and economics can earn you rent money and increase in value. Real estate gives you something physical to own, unlike paper investments, and helps fight inflation. But watch out for extra costs that change between countries—things like property management, upkeep, and foreign ownership taxes can add up fast.

4. Retirement plans for non-residents

Special retirement options, like Qualifying Recognised Overseas Pension Schemes (QROPS) or international personal pension plans, help you grow money tax-free if you move globally. You can invest in different currencies and types of assets. Please take a moment to compare fees before making a commitment, as high administration costs can impact your long-term returns.

Managing Investment Fees and Charges

Hidden costs silently eat away at your investment returns as you manage money across borders. Your expatriate wealth needs protection through a clear understanding of these expenses.

Understanding hidden costs in expat investments

Management fees are just the beginning. Expats face many more charges that include currency conversion costs (1-3%), custody fees for international assets, and higher advisory fees for cross-border expertise. These expenses add up over time and could reduce your returns by 20–30% in a decade.

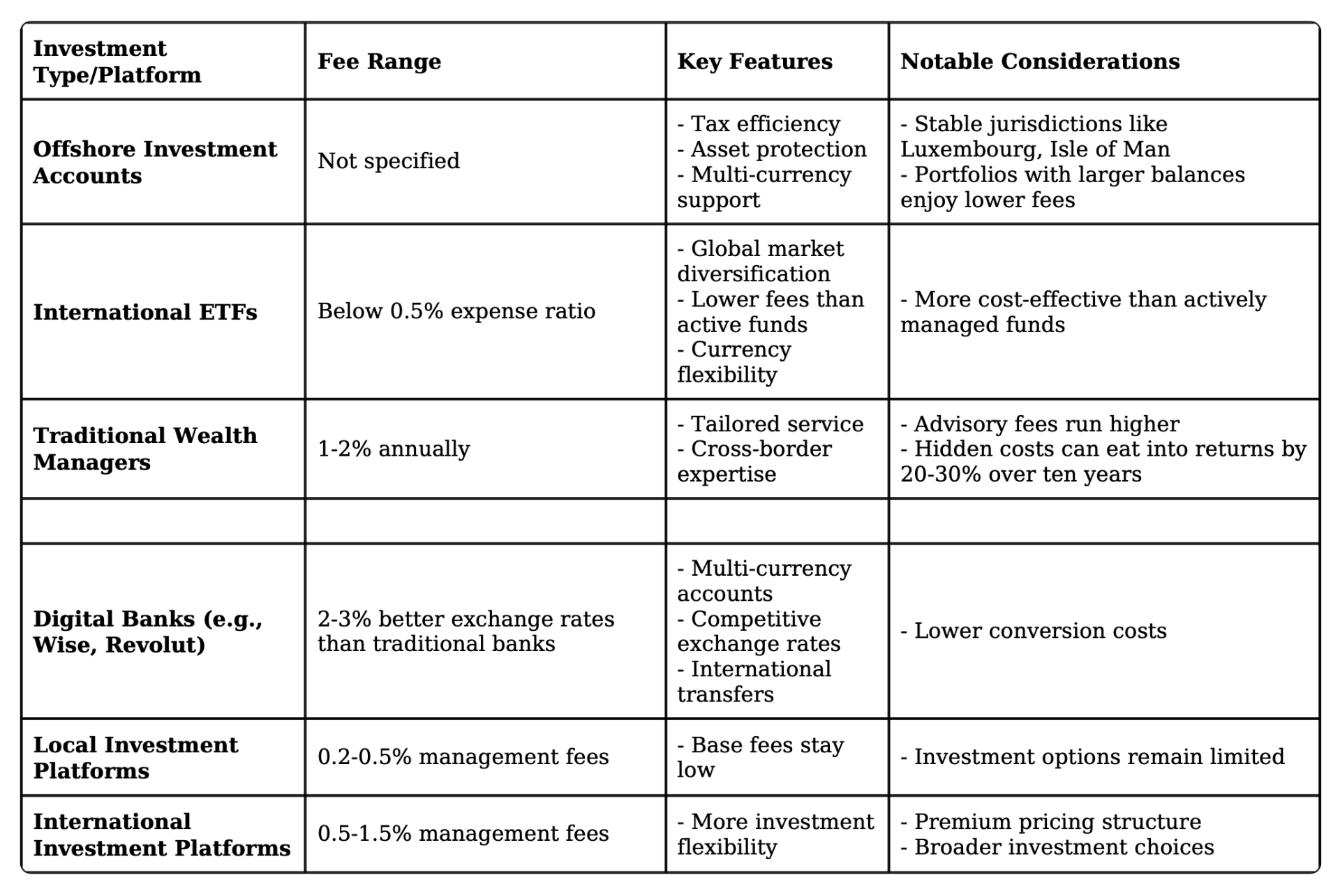

Investment fees comparison: local vs international platforms

Local platforms come with lower base fees but offer fewer investment choices. International platforms offer greater flexibility, albeit at a higher cost. To name just one example, domestic brokerages might charge 0.2-0.5% management fees, while international platforms typically range from 0.5-1.5%. Facts need verification beyond what others tell you; understanding how these structures work is significant. Performance-fee-based advice gives you the most transparent charging method.

How to reduce transaction and management fees

Your costs can be minimised through these steps:

Unite accounts to qualify for tiered fee reductions

Choose platforms with fixed rather than percentage-based fees for larger portfolios

Opt for low-cost ETFs instead of actively managed funds

Negotiate fees directly, especially with wealth management services

Review all investment-related expenses regularly to ensure they line up with the value received.

Tools and Platforms to Make Your Money Work Smarter

Technology makes managing your money across borders simple. Digital tools cut investment fees and give you better control of your global assets.

1. Multi-currency bank accounts

Digital banks like Wise and Revolut let you hold multiple currencies in one account without high conversion fees. These platforms beat traditional banks' exchange rates by 2-3%, so you save money on international transfers.

2. Budgeting apps with international support

YNAB and Mint track your spending in different currencies and show you exactly where your money goes, no matter where you are. These apps sort foreign transactions and convert them to your preferred currency to make reporting easier.

3. Tax optimization tools for global income

TaxAct and Expat Tax Tools focus on helping people who earn money in multiple countries find tax deductions that lower their global tax bill. They offer specific tools for different countries' tax treaties.

4. Investment tracking platforms

Personal Capital and Morningstar Portfolio X-Ray look at fees across your investments and show you ways to cut costs. These tools put investment fees side by side to expose hidden charges you might miss.

Comparison Table

Conclusion

Smart money management needs proactive planning and a close eye on investment fees when you live abroad. Expats face unique money challenges that locals never have to deal with. Your understanding of these challenges is your first step to building wealth as an expat.

The right investment choices make a huge difference to your long-term financial health. You can grow your wealth through offshore accounts, international ETFs, stable property markets, and special retirement plans. Each option has its fees, so doing your homework before investing your money is crucial.

Your returns can slowly disappear because of hidden costs. Small charges like currency conversion fees, advisory costs, and admin expenses add up. These fees can eat into your returns by 20–30% over a period of ten years. Regular fee checks should be part of your money management routine.

Modern tech has changed how expats handle their finances. Multi-currency accounts help you skip extra conversion fees. Smart budgeting apps and tax tools help boost your returns no matter where you live.

Your path to financial success as an expat starts when you ask the right questions about fees and understand what your investments really cost. Your success depends on how well you compare options, negotiate fees, and use technology. Living abroad gives you special financial opportunities—you just need to know how to make the most of them.