What Are High-Yield Bonds? A Clear Guide to Risks and Returns

What is a High-Yield Bond?

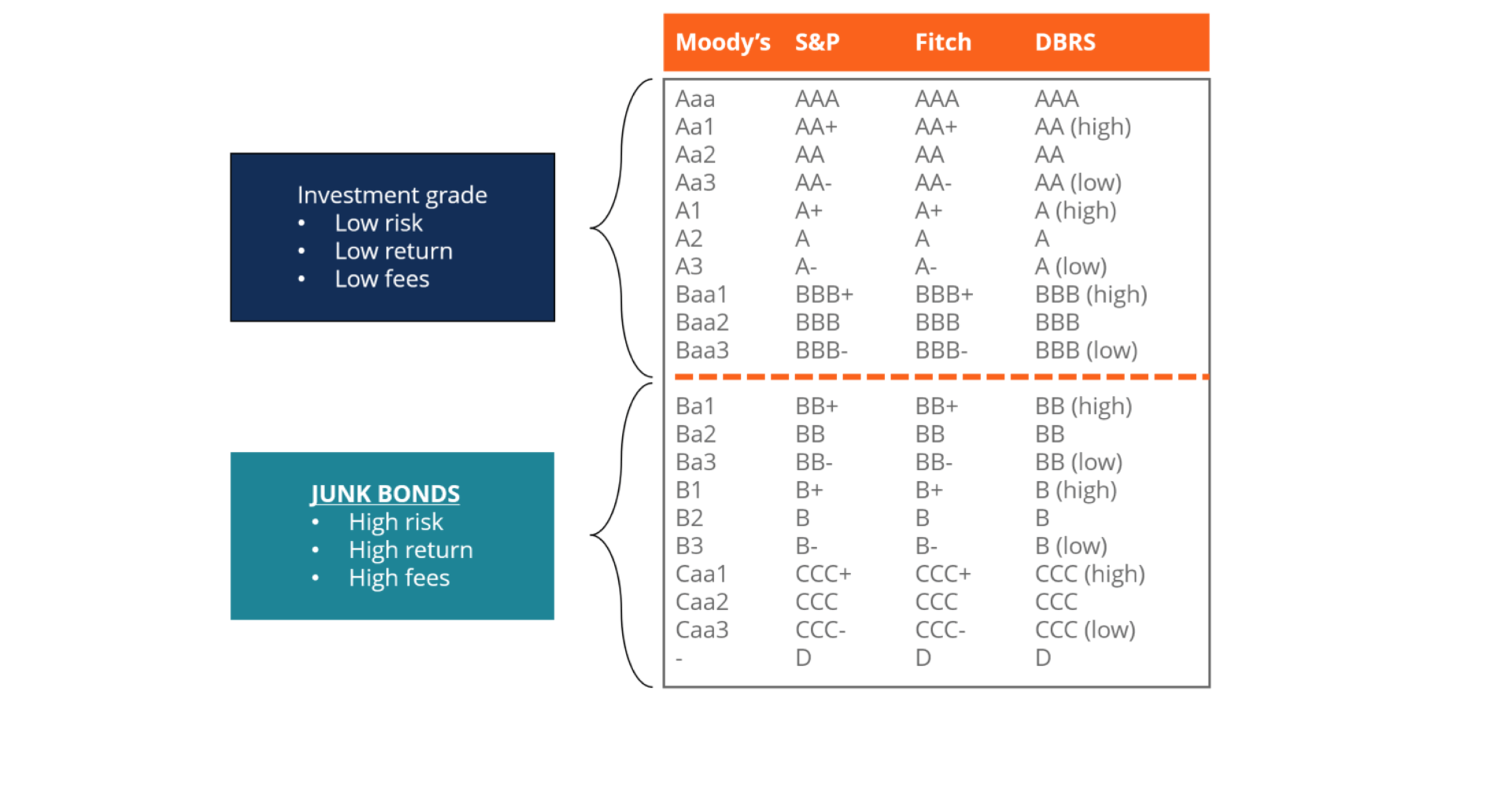

Image Source: Corporate Finance Institute

High-yield bonds are corporate debt securities with credit ratings below investment grade. People also know them as junk bonds or speculative-grade bonds. These bonds get ratings below BBB- from Standard & Poor's and Fitch, or below Baa3 from Moody's. They offer higher interest rates than investment-grade bonds because of their lower credit quality. This higher rate compensates investors who take on more default risk.

The bond market's high-yield sector has seen default rates average around 5% over time. These rates can jump substantially during tough economic times. They reached 5.6% to 7% in the 1989-90 liquidity crisis and climbed to just under 9% during the COVID-19 pandemic.

High-yield bonds usually come from several types of issuers:

Companies with high leverage or financial struggles

Smaller or emerging businesses that haven't proven themselves yet

Capital-intensive firms carrying high debt ratios

Companies with speculative or risky financial plans

High-yield bonds split into two subcategories:

Fallen angels—bonds that dropped from investment grade because the issuing company's credit quality got worse

Rising stars—bonds moving toward investment-grade status as their ratings improve, though they're still considered junk bonds

High-yield bonds might have higher default risk, but they come with some attractive benefits. They give investors better income opportunities and don't move in lockstep with other fixed-income sectors, which helps with diversification. There's also room for capital growth. These bonds tend to behave more like stocks than investment-grade bonds, though they don't swing as wildly as the stock market.

Big institutional players like pension funds, mutual funds, banks, and insurance companies buy most high-yield debt. Individual investors usually get into this market through mutual funds. Some institutional investors can't touch bonds below certain ratings because their bylaws say so. This rule affects who can buy lower-rated securities.

Like any investment, high-yield bonds balance risk and return. They pay more to make up for the higher chance of losing principal. These bonds often do better than lower-yielding options when the economy is growing and global markets are strong.

Why Do Investors Choose High-Yield Bonds?

Investors choose high-yield bonds because they offer three key advantages over other fixed-income investments.

Higher income potential

High-yield bonds offer significantly higher yields compared to investment-grade alternatives. These better returns are what make them attractive to investors. U.S. high-yield bonds showed a 7.5% yield compared to 5.33% for U.S. investment-grade bonds at the end of 2024. European high-yield bonds delivered 5.7% versus 3.18% for European investment grades. Past data shows investors who put money in at yield-to-worst levels between 5% and 7% usually earned yearly returns of about 5% or more over five years. The market produced positive three-year forward yearly returns 85% of the time when yields hit 7.7% or higher, with average returns of 8.0%.

Diversification benefits

High-yield bonds don't move in sync with investment-grade fixed-income sectors, including Treasuries and highly rated corporate debt. This feature helps investors build better-diversified portfolios and boost risk-adjusted returns. The historical record shows high-yield bonds have:

Less connection to traditional assets like stocks and government bonds

Smaller losses than stocks during market downturns

Bounced back faster from losses compared to stocks

Delivered stock-like returns with fewer ups and downs

Capital appreciation opportunities

High-yield bonds can grow in value beyond their regular income. A company's bond prices might rise if its financial health gets better and credit rating improves as the market sees less risk. Good economic conditions also boost investor confidence in riskier assets. This makes more people want high-yield bonds, which pushes prices up. Bond prices can rise because of:

Better ratings from credit agencies

Strong corporate earnings reports

Company mergers and buyouts

New management teams

Good news about products

Positive market events

High-yield bonds attract investors with their unique mix of steady income and growth potential. They're great for those who want reliable returns and a chance to grow their capital.

Are High-Yield Bonds Safe?

High-yield bonds come with safety risks due to their risky nature. These bonds need a full picture of multiple risks, unlike their investment-grade counterparts.

Credit and default risk

Default risk is what keeps high-yield bond investors up at night. The overall high-yield market shows default rates averaging about 5.65%. These rates can jump by a lot during tough economic times—going above 14% in the 2009 recession. Bondholders get some protection because they rank above equity investors when liquidation happens. B-category bonds rated B3 by Moody's or B- by S&P are three times more likely to default than B1 bonds.

Economic and market risk

The economy's health greatly affects how high-yield bonds perform. These bonds face heavy pressure during recessions. Companies make less profit during downturns and struggle to pay their debt. There's another reason things get tough—investors run to safer options like Treasury bonds when markets get shaky. High-yield bonds tend to move with stocks, but they react even more strongly when the economy slows down.

Liquidity concerns

Selling bonds at fair market value can be tricky. Here's why:

Rules that limit how much inventory broker-dealers can hold

Trading happens in bigger lots (10-25 times larger than investment-grade bonds) with lower volume

ETF prices can disconnect from their NAV when markets get rocky

Interest rate sensitivity

High-yield bonds react differently to interest rate changes than investment-grade bonds do. They're less sensitive to rate changes for a few key reasons. Their shorter time to maturity reduces duration. Higher coupon payments mean investors get more of their money back sooner, which also cuts duration. These bonds respond more to changes in credit spreads than interest rates. Rising rates still push high-yield bond prices down, but not as much as they affect longer-duration securities.

Who Should Invest in High-Yield Bonds?

High-yield bond investments work best with specific types of investors. You need to know your investment goals and how much risk you can handle before putting money into this fixed-income category.

Investors with high risk tolerance

High-yield bonds need investors who can handle more risk due to higher credit and default concerns. Your personal situation, including your income, net worth, and investment goals, should guide your decision to buy these instruments. These securities become risky during economic downturns because high-yield issuers usually have riskier business plans and more debt on their balance sheets.

Those seeking higher returns

Many investors choose high-yield bonds when they want better income potential. These bonds have performed better than investment-grade options over the last several years. Since 2000, they've delivered average annual returns of 6.5%, while short-term Treasuries returned only 2.6%. High-yield bonds give you a chance to boost your portfolio's yield if you're willing to take on extra credit risk.

People with diversified portfolios

High-yield bonds shine best as part of a well-diversified investment strategy. They help reduce overall portfolio risk because they don't move in sync with other fixed-income investments. Your portfolio stability can improve when you spread investments across different issuers, industries, and regions.

Long-term investors comfortable with volatility

Patient investors who can wait it out get the most from high-yield bonds. Market swings happen often with these securities, but history shows they reward investors who stick around through market cycles. The good news is that starting yields near 8% have reliably predicted strong future returns for investors who stay invested long enough.

Key Takeaways

High-yield bonds offer attractive income potential but require careful risk assessment. Here are the essential insights every investor should understand:

• High-yield bonds are "junk bonds" rated below investment grade, offering 7.5% yields versus 5.33% for investment-grade bonds to compensate for higher default risk.

• Default rates average 5% long-term but can spike to 14% during recessions, making economic timing and credit analysis crucial for investors.

• These bonds provide excellent portfolio diversification due to low correlation with traditional fixed income and faster recovery than equities during downturns.

• Best suited for risk-tolerant, long-term investors seeking higher returns within diversified portfolios who can withstand volatility cycles.

• Capital appreciation opportunities exist through credit upgrades, improved company fundamentals, and favourable market conditions beyond regular income payments.

High-yield bonds represent a compelling middle ground between stocks and investment-grade bonds, offering equity-like returns with lower volatility. However, success requires understanding credit cycles, maintaining proper diversification, and having the patience to ride out economic downturns when default risks peak.